01/04/ · I trade many price action techniques, this is one that is easy and effective. This is the one I use on the Weekly chart for good profits. Now these trades do not happen often, I get around 5 to 6 good ones a year, but when they do happen they are usually always good. In fact it is not hard to get more than to pips in a couple of month move 08/05/ · Moreover forex is a game in which you have to get into the pond and than can fish, mere by sitting on the brink will never make you a great fish hunter. coming over to trading the weekly charts, the pure idea behind trading them was the excellent level of technical analysis, shorting from a point or going long from a point which at least market Search within r/Forex. r/Forex. Log In Sign Up. User account menu. Found the internet! 3. Trading weekly charts. Close. 3. Posted by 1 year ago. Archived. Trading weekly charts. Hey all, Just starting to trade off the weekly charts. My assumption is that with some patience, safe lot size, and a wide stop loss it will be much easier to spot and

Forex Weekly Strategy Based on Moving Average - Forex Education

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site.

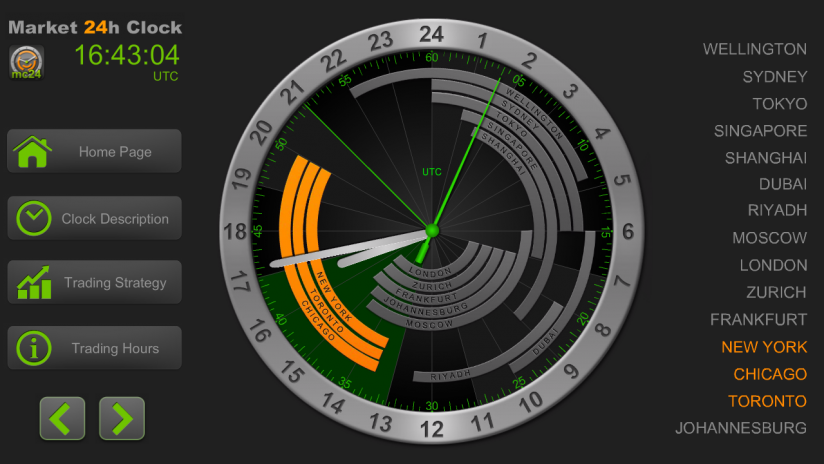

See our updated Privacy Policy here. Note: Low and High figures are for the trading day. Our trading charts provide a complete picture of live currency, stocks and commodities price movements and underpin successful technical analysis. Identify patterns and trends and respond to price action more effectively by typing in your forex trade weekly chart asset and applying moving averages, Bollinger Bands and other technical indicators to enhance your trading.

For more on technical analysis and how to use our free trading charts to trade forex and other assets, see our top 3 technical analysis charts for trading. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of Forex trade weekly chart US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. For more info on how we might use your data, see our privacy notice and access policy and privacy website.

Check your email for further instructions. Forex trade weekly chart Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0. Duration: min. P: R:. Search Clear Forex trade weekly chart results. No entries matching your query were found. English Français 中文(繁體) 中文(简体). Free Trading Guides. Please try again. Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook Market News Headlines.

Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements. Commodities Our guide explores the most traded commodities worldwide and how to start trading them.

Indices Get top insights on the most traded stock indices and what moves indices markets, forex trade weekly chart. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started, forex trade weekly chart.

Economic Calendar Central Bank Calendar Economic Calendar. Ifo Business Climate SEP. F: P: R: Business Confidence SEP.

Consumer Confidence SEP. Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides. Company Authors Contact. of clients are net long. of clients are net short. Long Short. Oil - US Crude. News Crude Oil Technical Outlook: Short-term Bias Still Bullish, Big Level Ahead Wall Street, forex trade weekly chart.

News Wall Street IG Client Sentiment: Our data shows traders are now net-short Wall Street for the first time since Sep 14, GMT when Wall Street traded near 34, Dow Jones Price Resilient After FOMC Rate Decision, Updated Rate Projections News Live Data Coverage: September Federal Reserve Meeting, Rate Decision Forex trade weekly chart View more.

Charts Follow our trading charts for the latest price data across forex and other major financial assets. Euro - Dollar Chart. How to Use Trading Charts for Effective Analysis Our trading charts provide a complete picture of live currency, stocks and commodities price movements and underpin successful technical analysis.

Free Trading Guide. Get Your Free Top Trading Opportunities Forecast, forex trade weekly chart. Get My Guide. New Zealand Dollar Forecast: Bull Moves Back on Track?

How to Read a Candlestick Chart Top 8 Forex Trading Strategies and their Pros and Cons Real Time News. DailyFX Sep 24, Follow. Did you know a Doji candlestick signals market indecision and the potential for a change in direction. What are the top five types of Doji candlesticks? Gold prices failed to retake the uptrend from the MayMarchand March lows, and are nearing their monthly low.

The US Dollar continues to push higher against ASEAN currencies after the FOMC rate decision. ddubrovskyFX Sep 24, Follow. Do you know how to properly Forex trade weekly chart a double top formation? Double tops can enhance technical analysis when trading both forex or stocks, making the pattern highly versatile in nature. Sep 24, Forex trade weekly chart. Economic Calendar. Household Lending Growth YoY AUG.

P: R: 6. PPI MoM AUG. P: R: 2. PPI YoY AUG. Ifo Current Conditions SEP. Ifo Expectations SEP. Market News Market Overview Real-Time News Forecasts Market Outlook. Market Data Rates Live Chart. Calendars Economic Calendar Central Bank Rates. Education Trading courses Free Trading Guides Live Webinars Trading Research Education Archive. DailyFX About Us Authors Contact Archive.

First Name: Please fill out this field. Please enter valid First Name. Last Name: Please fill out this field. Please enter valid Last Name. E-Mail: Please fill out this field. Please enter valid email, forex trade weekly chart. Please select a country. Close window. Questions or Comments? Contact us at research dailyfx.

Weekly Trend 1 Hour Pullback Trading Strategy

, time: 15:52Trading Weekly Forex Charts | Forex Trading Strategies

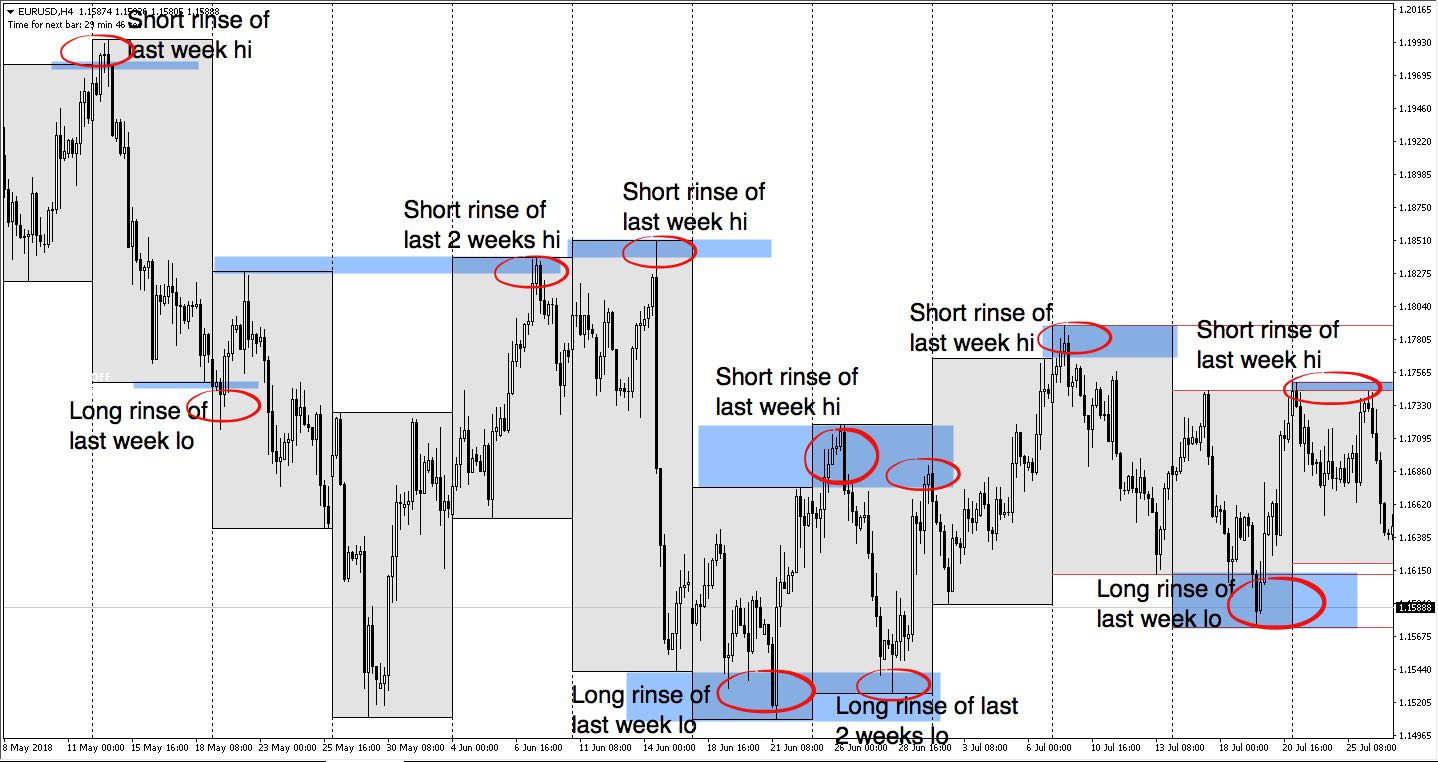

Always do your own analysis and research and be expressly aware of the risks and rewards in trading or investing in any financial product. September Offer: Get 60% Off Nial Fuller’s Pro Trading Course Here. Weekly Trade Ideas: USDJPY, GBPUSD & S&P – Sep 6th to 10th, By Nial Fuller in Forex Trading Signals, Trade Ideas & Chart 26/01/ · Indicators: ATR (14) on the WEEKLY chart, or use the attached indicator on your. 4H chart. THE STRATEGY. With the start of the trading week on Monday, find the Friday candle. On a 4H chart find the high and low of the Friday candle. Entry: Set BUY STOP order 10 pips above the high.- Set SELL STOP order 10 pips below the low But with trading on the weekly charts, a trader can continue to grow their account and continue to see good returns because the trade is based on a larger time frame. GBPAUD Weekly Chart. $ USD. It is recommended that you have read the Forex Strategies Guide for Day and Swing Traders before studying this Weekly blogger.comted Reading Time: 9 mins

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-02-f9a2aa69cf4f4546b2ed3857797e8be8.jpg)