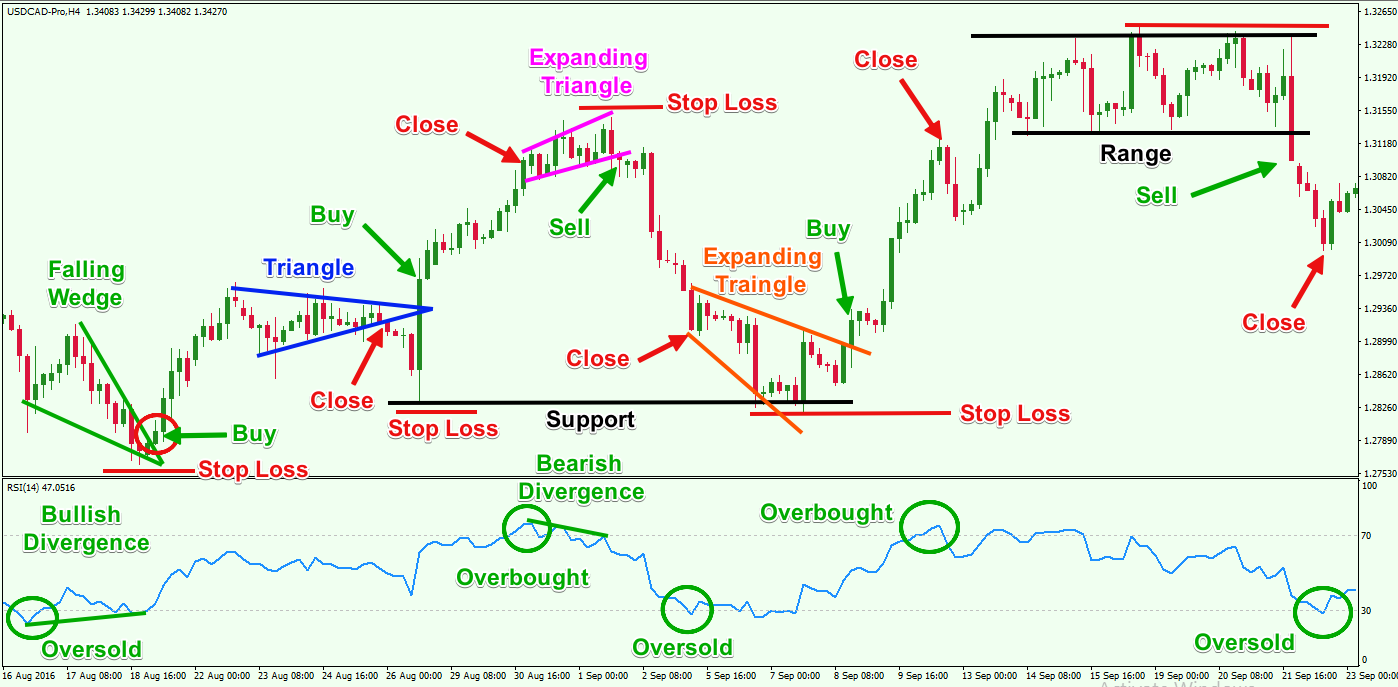

3/13/ · The RSI strategies are highly useable and powerfull strategies. These are the forex trading strategies. The RSI strategies can give more better results and accurate information if they will used with the combination of ther indicators. As these are forex strategies so these strategies can also be used with any currency pairs RSI Simple Forex Trading Strategies For (Alert Arrow 2/11/ · According to Investopedia, the Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the prices of a stock or other blogger.com: Joe Perry

How to Use RSI (Relative Strength Index) in Forex - blogger.com

Relative Strength Indexor RSI, is a popular indicator developed by a technical analyst named J. Welles Wilderthat helps traders evaluate the strength of the current market. RSI is similar to Stochastic in that it identifies overbought and oversold conditions in the market. It is also scaled from 0 to Typically, readings of 30 or lower indicate oversold market conditions and an increase in the possibility of price strengthening going up.

Readings of 70 or higher indicate overbought conditions and an increase in the possibility of price weakening going down, forex about rsi. In addition to the overbought and oversold indicators mentioned above, traders who use the Relative Strength Index RSI indicator also look for centerline crossovers. A movement from below the centerline 50 to above indicates a rising trend. A rising centerline crossover occurs when the RSI value crosses ABOVE the 50 line on the scale, moving towards the 70 line.

This indicates the market trend forex about rsi increasing in strength, forex about rsi, and is seen as a bullish signal until the RSI approaches the 70 line. A movement from above the centerline 50 to below indicates a falling trend. A falling centerline crossover occurs when the RSI value crosses BELOW the 50 line on the scale, moving towards the 30 line. This indicates the market trend is weakening in strength, and is seen as a bearish forex about rsi until the RSI approaches the 30 line.

RSI can be used just like the Stochastic indicator. We can use it to pick potential tops and bottoms depending on whether the market is overbought or oversold. On June 7, it was already trading below the 1. However, RSI dropped below 30, signaling that there might be no more sellers left in the market and that the move could be over. RSI is a very popular tool because it can also be used to confirm trend formations. If you think a trend is forming, forex about rsi, take a quick look at the RSI and look at whether it is forex about rsi or below Sure enough, as RSI passes below 50, it is a good confirmation that a downtrend has actually formed.

Partner Forex about rsi Find a Broker.

Best RSI Indicator Settings for Forex Swing Trading

, time: 16:11Using RSI in Forex Trading

2/22/ · Summary of the RSI Forex trading strategies. I will sum up in a few paragraphs: 1. Relative Strength Index is a leading indicator measuring the trend strength. It is used to confirm entry signals. 2. The index value changes in the range from 0 to The default signal levels are 30 and The price range between levels 30 and 0 is the oversold blogger.com: Oleg Tkachenko 3/13/ · The RSI strategies are highly useable and powerfull strategies. These are the forex trading strategies. The RSI strategies can give more better results and accurate information if they will used with the combination of ther indicators. As these are forex strategies so these strategies can also be used with any currency pairs 5/24/ · The relative strength index (RSI) is most commonly used to indicate temporarily overbought or oversold conditions in a market. An intraday forex trading strategy can be devised to take advantage of

No comments:

Post a Comment