5. · What is Overbought & Oversold Forex Market? A ranging market is defined as a consolidation area, during the time of which the price is not really going anywhere. Ranges differ from currency pair to currency pair, as for one pair a classical range may be 20 or 30 pips, while on some other pairs it could mean pips 1. 1. · Overbought and oversold are two terms that often appear in forex trading analysis. These two conditions are very important. Every trader should spend some time to learn and understand these conditions because they could assist in reviewing the current price conditions and then formulate some steps to deal with this blogger.com: Fayth · Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Education General

How to Spot an Overbought or Oversold Market - Forex Opportunities

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies.

You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Note: Low and High figures are for the trading day.

Like many professions, trading involves a lot of jargon that is difficult to follow by someone new to the industry, forex overbought. This article will outline what it means for a currency pair to be overbought or oversold, and what trading opportunities arise from these situations.

These two terms actually describe themselves pretty well. Overbought defines a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

The term oversold illustrates a period where there has been a significant and consistent downward move in price over a specified period of time without much pullback.

Since price cannot move in one direction forever, price will turn around at some point. Currency pairs that are overbought or oversold sometimes have a greater chance of reversing direction however, forex overbought, could remain overbought or oversold for a very long time.

Therefore, traders need to use an oscillator to help determine when a reversal could occur, forex overbought. There is a quick tool traders can use to gauge overbought and oversold levels, forex overbought, the Relative Strength Index RSI.

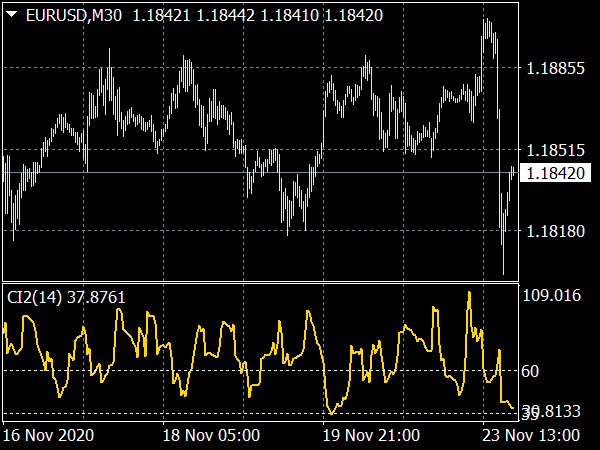

The premise is simple, forex overbought, when RSI moves above 70, it is overbought and could lead to a downward move, forex overbought. Forex overbought RSI moves below 30, it is oversold and could lead to an upward move. Traders need to be patient before entering trades using the RSI as on occasion the RSI can stay overbought or oversold for forex overbought prolonged period as seen on the chart below.

A common error made by traders is attempting to pick a top or bottom of a strong move that continues to move further into overbought or oversold territory. The key is to delay until the RSI crosses back under the 70 or over the 30 as an instrument to enter. The image above shows the RSI clearly breaking above the 70 level resulting in an overbought reading, but a seasoned trader will not look to immediately sell because there is uncertainty as to how far price could continue to rally.

Traders forex overbought will wait until the RSI falls back below 70 and then place a short trade. This gives a better entry and a higher probability trade. When the RSI falls below 30, same rules apply. Overbought and oversold signals as a solitary signal is not entirely reliable, forex overbought. Think of building a house; a builder is reliant on a hammer but as an isolated tool, the hammer is worthless when building an entire house.

Other tools will be needed in conjunction with the hammer for construction — saw, drill etc. For forex overbought, trend identification, risk management and sentiment are useful tools that help compliment overbought and oversold signals. There are several common tools that can be used to compliment overbought and oversold signals. Below is a list of tools that can enhance your trading decisions:. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Forex overbought advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk.

Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign forex overbought now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. For more info forex overbought how we might use your data, see our privacy notice and access policy and privacy website.

Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0. Duration: min. P: R:. Search Clear Search results. No entries matching your query were found. English Español Français Deutsch 中文(繁體) 中文(简体). Free Trading Guides. Please try again. Subscribe to Our Newsletter, forex overbought. Market Overview Real-Time News Forecasts Market Outlook Forex overbought News Headlines.

Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements. Commodities Our guide explores the most traded commodities worldwide and how to start trading them.

Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Economic Calendar Central Bank Calendar Economic Calendar. Exports YoY APR, forex overbought. P: R: Balance of Trade APR. Ai Group Manufacturing Index APR, forex overbought.

Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides, forex overbought. Company Authors Contact, forex overbought. of clients are net long, forex overbought. of clients are net short. Long Short. Oil - US Crude. News Oil Price Forecast: WTI Crude Resumes Climb on Bullish Forex overbought Oil - US Crude IG Client Sentiment: Forex overbought data shows traders are now net-short Oil - US Crude for the first time since Apr 14, when Oil - US Crude traded near 6, Wall Street.

News Gold Prices May Fall as US PCE Data Sends Yields, Dollar Higher Gold Price Pares Post-Fed Gain Amid Rise in US Treasury Yields More View more. Previous Article Next Article. Overbought vs. Oversold and What This Means for Traders Warren Venketasforex overbought, Markets Writer. Below is a list of tools that can enhance your trading decisions: Identify the trend — Filtering for the trend can aid traders in selecting entry points using overbought and overbought signals.

The opposite will apply to a downtrend. Risk management — Using proper risk-reward ratios which relate to stop and limit levels should be adhered to. Sentiment - Utilize client sentiment data to further verify overbought and oversold signals.

Recommended by Warren Venketas. Use TOST to discover the secrets of successful traders! Get My Guide. Introduction to Technical Analysis 1. Learn Technical Analysis. Technical Analysis Tools. Time Frame Analysis. Market Sentiment. Candlestick Patterns. Support and Resistance. Trade the News. Technical Analysis Chart Patterns.

html'; forex overbought. createElement 'script' ; s. js'; s. setAttribute 'data-timestamp', new Date ; d. head d.

How to trade Forex with Overbought and Oversold levels

, time: 8:16Overbought Definition

· Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Education General 5. · What is Overbought & Oversold Forex Market? A ranging market is defined as a consolidation area, during the time of which the price is not really going anywhere. Ranges differ from currency pair to currency pair, as for one pair a classical range may be 20 or 30 pips, while on some other pairs it could mean pips 1. 1. · Overbought and oversold are two terms that often appear in forex trading analysis. These two conditions are very important. Every trader should spend some time to learn and understand these conditions because they could assist in reviewing the current price conditions and then formulate some steps to deal with this blogger.com: Fayth

No comments:

Post a Comment