23/02/ · In forex trading, a Stop Out Level is when your Margin Level falls to a specific percentage (%) level in which one or all of your open positions are closed automatically (“liquidated”) by your broker. This liquidation happens because the trading account can no longer support the open positions due to a lack of margin A stop out level in forex is something that happens when a trader’s open positions are automatically closed by their forex broker. This occurs because the trader, who is trading with leverage, runs out of available margin. Leverage means that the trader is trading a position with money that they do not technically have A stop out in Forex usually happens at the 50% margin level. In real numbers, it means that the funds on the account are half the size of the funds taken by the broker. And at this point, the positions will be closed automatically until the margin level goes above 50%. What is the difference between the Forex stop out level and a stop out?

What is a Stop Out Level in Forex?|Stop Out Calculator - ForexFreshmen

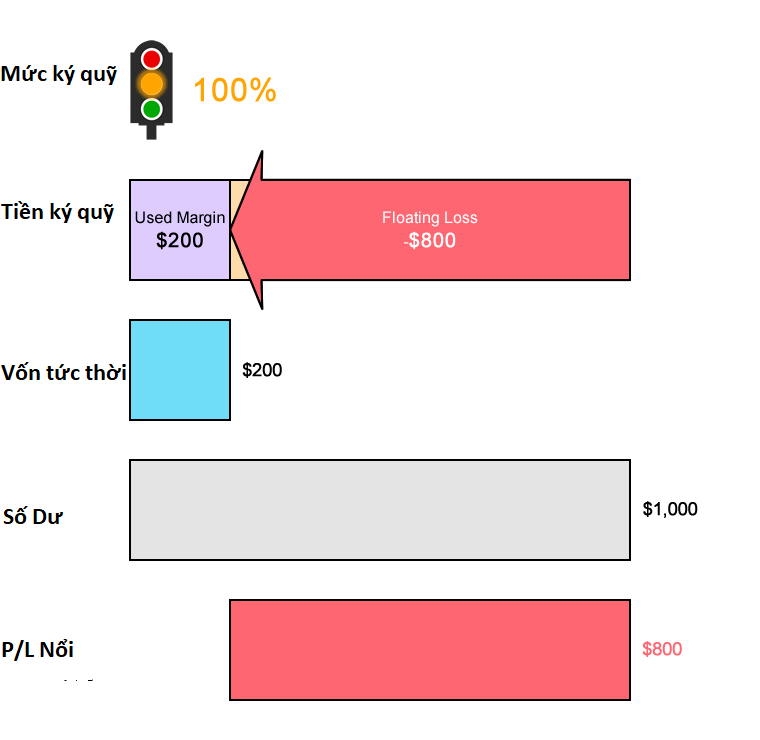

This liquidation happens because the trading account can no longer support the open positions due to a lack of margin. More specifically, the Stop Out Level is when the Equity is lower than a specific percentage of your Used Margin.

If this level is reached, your broker will automatically start closing forex stop out level your trades starting with the most unprofitable one until your Margin Level is back above the Stop Out Level.

If your Margin Level is at or below the Stop Out Level, the broker will close any or all of your open positions as quickly as possible in order to protect you from possibly incurring further losses.

Keep in mind that a Stop Out is not discretionary, forex stop out level. Once the liquidation process has started, it is usually not possible to stop it since the process is automated. The Stop Out Level is also known as the Margin Closeout Value, Liquidation Margin, or Minimum Required Margin. A sucky crazy trader. If you experience a Stop Out and see the aftermath in your account, this is how your eyes feel….

If you had multiple positions open, the broker usually closes the least profitable position first. Brokers would prefer not to have to come knocking on your door with a baseball bat to collect the unpaid balance, so a Stop Out is meant to try and… STOP… your Balance from going negative.

The example above covered the scenario with you trading a single position. But what if you had MULTIPLE positions open? Each broker has its own specific liquidation process so be sure to check with yours. Remember, YOU, and YOU aloneare responsible for monitoring your account and making sure you are maintaining the required margin at all times to support your open positions, forex stop out level.

Obstacles are forex stop out level frightful things you see when you take your eyes off your goals. Henry Ford. Partner Center Find a Broker.

What Is Stop Out? - FXTM Learn Forex in 60 Seconds

, time: 1:05Forex stop out level | What does it mean and how to avoid it?

A stop out level in forex is something that happens when a trader’s open positions are automatically closed by their forex broker. This occurs because the trader, who is trading with leverage, runs out of available margin. Leverage means that the trader is trading a position with money that they do not technically have What is a Stop Out Level? - blogger.com A stop out in Forex usually happens at the 50% margin level. In real numbers, it means that the funds on the account are half the size of the funds taken by the broker. And at this point, the positions will be closed automatically until the margin level goes above 50%. What is the difference between the Forex stop out level and a stop out?

No comments:

Post a Comment