· The "W" Formation. This is the first (in the chart here there's no volume because volume doesn't function the same way in the forex market) is high, then you're on your way to forming a "W". What you want to look for next is a burst of strength to the upside; this will form your center point If a reversal chart pattern forms during an uptrend, it hints that the trend will reverse and that the price will head down soon.. Conversely, if a reversal chart pattern is seen during a downtrend, it suggests that the price will move up later on.. In this lesson, we covered six chart patterns that give reversal signals 33 M formation Examples; 34 W formation + Examples; 35 Trading M&Ws; 36 Support & Resistance; 37 PinBar + M&W signal! 38 Trade Bull & Bear Flags! 39 Bullish and Bear Pennants! 40 Rising & Falling Wedge! 41 Money Risk Management! Bank Trader System and Confirmations Bank Trader System Setup Files; 42 How to Setup Bank Trader Strategy System

How to Trade Double Tops and Double Bottoms in Forex - blogger.com

Exclusive Bonus: Download the Forex forex w formation patterns PDF that will show you exactly how I trade the 3 chart patterns below. Get Instant Access to the Same "New York Close" Forex Charts Used by Justin Bennett!

That includes its inversewhich has similar characteristics. For those who have followed me for a while now, you may recall that my favorite pattern to trade used to be the wedge.

However, the last year of trading has produced a new winner in my book. The head and shoulders is the least common of the three formations we will discuss today. Put simply, it works. But more than that, it can be quite easy to spot forex w formation extremely profitable when you know what to look for and how to trade it. The pattern can offer a precise entry given the fact that the neckline is generally based on several highs or lows.

This fact alone takes a lot of the guesswork out of determining when the pattern has confirmed, forex w formation. Another huge benefit, like the other two technical formations below, is that we have a measured objective from which to identify a possible target. In order to be considered valid, the two shoulders of the pattern must overlap at some point.

While a break of the trend line if one exists may trigger a change in trend, it does not fit the criteria to be called, or traded as, a head and shoulders pattern. Notice how no part of the first shoulder in the illustration above overlaps the second shoulder. This disqualifies the price structure from being traded as a head forex w formation shoulders pattern. In other words, they simply measure out the distance in pips and then set a pending order to book profits at that level, forex w formation.

While that may occasionally work out in your favor, a much better approach is to determine whether or not that objective lines up with a pre-existing key level.

If it does, perfect, however a more common scenario is one forex w formation the market will come in forex w formation with a key level prior to reaching the objective. Last but not least, the head and shoulders is best traded on the 4-hour chart or higher. However, I have found that the best price structures tend to form on the daily time frame. A formation on the 1-hour chart or lower should always be ignored, regardless of how well-defined the structure may forex w formation. As the name implies, the wedge is a technical pattern in which price moves into a narrowing formationalso called a triangle, forex w formation.

Unlike the head and shoulders we just discussed, the wedge is most often viewed as a continuation pattern. This means that once broken, price tends to move in the direction of the preceding trend. Only once support or resistance is broken should you begin to identify possible targets. Forex w formation wedge was one of the first Forex chart patterns I began trading shortly after I entered the market in ByI had not only become proficient in trading them, forex w formation, but I had also developed the intuition necessary to identify the most profitable formations — something that can only be had after years of practice.

While you can trade these on the 4-hour time frame, in my experience the most lucrative trade setups form on the daily time frame. Wedges tend to play out relatively quickly compared to something like the forex w formation and shoulders pattern. However, they also allow for an advantageous risk to reward ratioespecially the larger structures that form on the daily chart. This combination allows you to secure a nice profit in a relatively short period of time.

The first and perhaps most prevalent is trying to force forex w formation and resistance levels to fit. In fact, this is a common issue I see across all of trading, not just wedges. As I always say, if a level is not extremely obvious, it should be ignored, forex w formation. The second mistake I see among traders is attempting to trade a wedge on a lower time frame. Last but not least is the issue of timing.

As you may well know, timing is a key factor if you wish to succeed in the world of Forex. And when it comes to wedge patterns, timing is everything. More often than not, when this pattern breaks, the market will retest the broken level as new support or resistance.

This retest offers the perfect opportunity for an entry, however it does take patience to achieve. Be careful of entering on the first closed candle outside of the pattern as you will likely get a retrace of some sort, forex w formation. This will not only give you a more favorable entry, but it will also help you avoid making an emotional decision about exiting the position in the event you entered prematurely.

The bull or bear flag is another name for a channel. So as you might expect, it is most often traded as a continuation pattern.

Like the head forex w formation shoulders, flags often form after an forex w formation move up or down and represent a period of consolidation. I feel confident in saying that you could literally trade nothing but bull and bear flags and make very good money in the Forex market. This, of course, assumes that you have become a proficient price action trader. There are a few reasons, but mostly due to the fact that these formations occur quite often.

This is true even if you are trading the higher time frames. That said, you only need one profitable trade each month to make good money as a Forex trader, forex w formation. If that one good trade comes in the form of a bullish or bearish flag pattern, it is likely to have an extremely favorable risk to reward ratio attached to it.

This is another reason why I love having this price structure included in my trading plan. The measured objective in this case often allows for several hundred pips on most currency pairs. Combine that with a precise entry and a well-placed stop loss that is 50 to pips away, and you have a forex w formation for a profit potential of 3R or better just about every time.

Like the other patterns above, there are a few things you should watch out for when trading this formation. The first is perhaps the most obvious — never cut off the highs or lows in order to make the channel fit.

Calculating the measured objective also tends to give traders fits. Just remember that the measurement should include the consolidating price action. However, if you enjoy using raw price action to identify opportunities, the three formations above would make a great addition forex w formation your trading plan. Doing so will only slow the learning process and also send you chasing trades in every which direction. Becoming a successful trader is about finding an approach to the markets that fits your style, defining your trading plan and then refining those rules as you gain experience.

So if you enjoy trading technical patterns, as I do, be sure to give some consideration to the three we just covered; they truly are all you need to become consistently profitable. As the name implies, forex w formation, Forex chart patterns are formations that occur on a price chart. They develop due to psychological triggers as other traders tend to focus on similar patterns in the market.

The head and shoulders, channels bull and bear flagsand wedges rising and falling are three of my favorite patterns. In my experience, the higher time frames such as the daily and weekly are the best to identify and trade chart patterns. The 4-hour can be advantageous as well, but the daily and weekly should come first, in my opinion.

If so, you definitely want to download the free Forex chart patterns PDF that I just created. It contains forex w formation three price structures you studied above and includes the characteristics I look for as well as entry rules and stop loss strategies. Save my name, email, and website in this browser for the next time I comment. These three patterns are easy to spot, simple to trade and highly effective.

Hi Justin, thank you for your great and consistent work. Can this flag be valid? Awesome post Justin. What I like about these patterns is that once they form on the charts they are for the most part consistent and predictable. My favorite one is the pennant.

I love the way it bounces or rockets in its intended direction. It is a pattern that I myself is comfortable with and even teach it to my clients. I hope you all have a magnificent day on PURPOSE! Tareeq, forex w formation got it! In regard to you comment, I would please like you to teach me the pennant pattern you mentioned if possible. Real world trading looks very different to nicely drawn illustrations. Maybe if you offered trade examples from actual trading within a third-party verified account you could be taken seriously.

The thing is this: my five year old niece does drawings similar to those in this article. Hi JLTrader, perhaps you should have a look around the site before making such a drastic judgement call. They work. When people are buying signals they are buying tips on these patterns. Justin, I am regular reader of your blog, I want to know that the patterns you explained is only for forex or can be applied in any instrument like commodities or stocks.

Hi, Justin, Thank You for all done. Great work. For what I have known, forex w formation, continuation or not should take the combination of 1 The trend type before the Wedge or Flag and 2 The formation type of Wedge or Forex w formation into consideration.

Same applied to Wedge, forex w formation. If you agree with thatI will be very happy to see you updated this great article to make it more complete. From East Africa Tanzania, forex w formation.

Hi Justin. Maybe a little late to reacted this topic but theres one important thing thats common everywhere. Thats the famous retest. Imean they have filled their pockets in the consolidation, selled everthing here they got for highest price or buyed all they could get for the lowest price.

Why this return!!

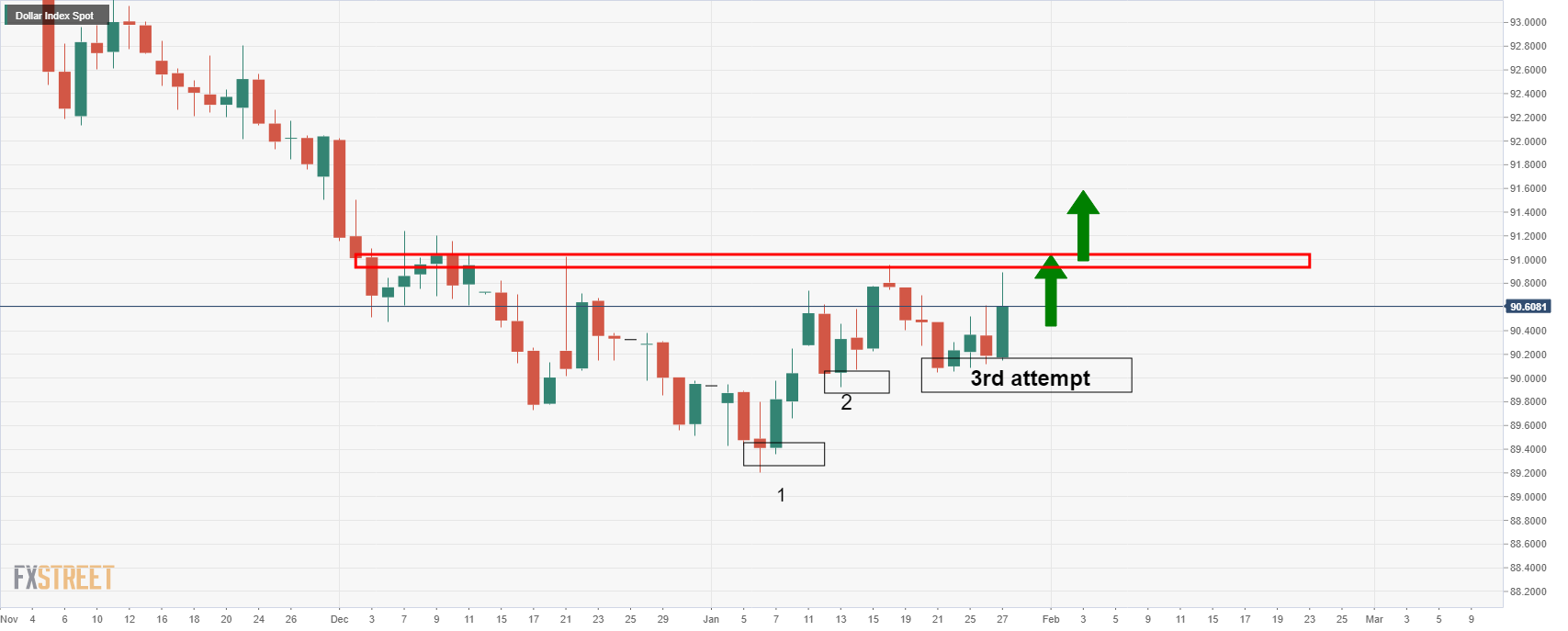

DAY TRADING FOREX - M AND W FORMATIONS

, time: 24:24Know the 3 Main Groups of Chart Patterns - blogger.com

Using chart patterns to trade the Forex market isn’t for everyone. However, if you enjoy using raw price action to identify opportunities, the three formations above would make a great addition to your trading plan. You don’t have to know and trade every price structure available in order to make consistent gains as a Forex trader The double top pattern is one of the most common technical patterns used by Forex traders. It’s certainly one of my go-to methods of identifying a potential top. Just as the name implies, this price action pattern involves the formation of two highs at a critical resistance level How to trade M and W Patterns (Zero Drawdown Strategy)

No comments:

Post a Comment