Complete Overview on Long vs Short Positions in Forex Trading. If you are a beginner in Forex Trading than you will need to understand the basic terms of the forex before going to start. In this article, we will discuss the long and short position in the fundamental of forex blogger.comted Reading Time: 4 mins /02/13 · Having a long or short position in forex means betting on a currency pair to either go up or go down in value. Going long or short is the most elemental aspect of engaging with the markets. When a Author: David Bradfield Short Term Vs. Long Term Forex Trading. Short-term and long-term trading can be profitable, and success is not related to the type of trading but rather by personality, trading strategy, and market environment. For example, if the market is in the range and the long-term trader Estimated Reading Time: 8 mins

Long or Short | Daily Price Action

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies, forex long vs short. You can learn more about our cookie policy hereforex long vs short, or by following the link at the bottom of any page on our site. See our updated Privacy Policy here. Note: Low and High figures are for the trading day. Understanding the basics of going long or short in forex is fundamental for all beginner traders.

Taking a long or short position comes down to whether a trader thinks a currency will appreciate go up or depreciate go downrelative to another currency. Keep reading to find out more about long and short positions in forex trading and when to use them. A forex position is the amount of a currency which forex long vs short owned by an individual or entity who then has exposure to the movements of the currency against other currencies.

The position can be either short or long. A forex position has three characteristics:. Traders can take positions in different currency pairs, forex long vs short. If they expect the price of the currency to appreciate, forex long vs short, they could go long. The size of the position they take would depend on their account equity and margin requirements. It is important that traders use the appropriate amount of leverage. DailyFX features IG client sentiment for a full overview of what positions traders are taking in the forex market.

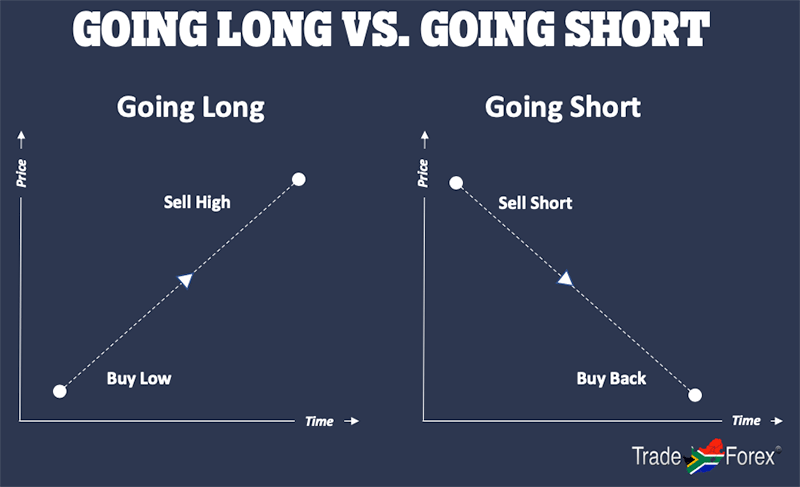

Having a long or short position in forex means betting on a currency pair to either go up or go down in value. Going long or short is the most elemental aspect of engaging with the markets.

When a forex long vs short goes long, he or she will have a positive investment balance in an asset, with the hope the asset will appreciate.

When short, he or she will have a negative investment balance, with the hope the asset will depreciate so it can be bought back at a lower price in the future. A long position is an executed trade where the trader expects the underlying instrument to appreciate. For example, when a trader executes a buy order, they hold a long position in the underlying instrument they bought i. Here they are expecting the US Dollar to appreciate against the Japanese Yen. Learn more about forex quotes with our guide to reading currency pairs.

Traders look for buy-signals to enter long positions. I ndicators are used by traders to look for buy and sell signals to enter the market. An example of a buy signal is when a currency falls to a level of support. This level of Some traders prefer to trade during the forex long vs short trading sessions like the New York session, London session and sometimes the Sydney and Tokyo session because there is more liquidity.

A short position is essentially the opposite of a long position. When traders enter a short position, they expect the price of the underlying currency to depreciate go down. To short a currency means to sell the underlying currency in the hope that its price will go down in the future, allowing the trader to buy the same currency back at a later date but at a lower price.

The difference between the higher selling price and the lower buying price is profit. Traders look for sell-signals to enter short positions. A common sell-signal is when the price of the underlying currency reaches for level of resistance. A level of resistance is a price level that the underlying has struggled to break above. This level becomes a resistance level and offers traders a sell-signal when the price reaches for Some traders prefer to trade only during the major trading sessions, although if an opportunity presents itself, traders can execute their trade virtually anytime the forex market is open, forex long vs short.

It is also important to understand the number one mistake traders make when trading forex. When you start your trading journey, you can download our free currency forecasts covering the major FX pairs. These are compiled by our experts here at DailyFX who also host daily trading webinars and provide regular updates on the forex market. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

We advise you to carefully consider forex long vs short trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY Forex long vs short Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content.

For more info on how we might use your data, see our privacy notice and access policy and privacy website. Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0. Duration: min, forex long vs short.

P: R:. Search Clear Search results. No entries matching your query were found. English Français 中文(繁體) 中文(简体). Free Trading Guides. Please try again. Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook Market News Headlines. Rates Live Chart Asset classes.

Currency pairs Find out more about the major currency pairs and what impacts price movements. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets, forex long vs short.

Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Economic Calendar Central Bank Calendar Economic Calendar. Fed Williams Speech. Federal Election. Industrial Profits YTD YoY AUG. P: R: forex long vs short Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides.

Company Authors Contact. of clients are net long. of clients are net short. Long Short. Oil - US Crude. News Crude Oil Technical Outlook: Short-term Bias Still Bullish, Big Level Ahead Wall Street. News Wall Street IG Client Sentiment: Our data shows traders are now net-short Wall Street for the first time since Sep 14, GMT when Wall Street traded near 34, Dow Jones Price Resilient After FOMC Rate Decision, Updated Rate Projections News Gold Weekly Technical Forecast: Bearish Price Action Points to More Weakness More View more.

Previous Article Next Article. Long vs Short Positions in Forex Trading David BradfieldMarkets Writer. What is a position in forex trading? A forex position has three characteristics: The underlying currency pair The direction long or short The size Traders can take positions in different currency pairs.

What does it mean to have a long or short position in forex? What is a long position and when to trade it? Recommended by David Bradfield. Get the basics right with our beginner guide to forex. Get My Guide, forex long vs short. Foundational Trading Knowledge 1. Forex for Beginners.

LONG AND SHORT TRADES IN FOREX

, time: 7:39What is Long and Short Trading? - Forex Education

Long vs Short Positions in Forex Trading Understanding the basics of going long or short in forex is fundamental for all beginner traders. Taking a long or short position comes down to whether a trader thinks a currency will appreciate (go up) or depreciate (go down), relative to another currency /09/20 · A Forex position, which can be either long or short, represents the amount of an asset which is held by a certain party who has exposure to the price movements of the currency against a basket of other currencies. Each Forex position is defined by its underlying currency pair, its long or short direction and blogger.comted Reading Time: 3 mins Long or short – it is the question. Recently we wrote an article about long trades vs. short. Just like giving long options while trading, many software writes short instead of selling. Even traders use terminology such as “I am thinking of going short on Facebook.” Short selling allows traders to sell what they don’t blogger.comted Reading Time: 6 mins

No comments:

Post a Comment