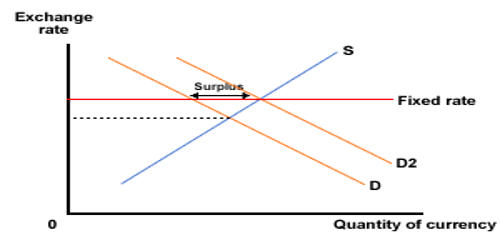

22/12/ · A fixed exchange rate is a regime applied by a government or central bank that ties the country's official currency exchange rate to another country's currency or the price of gold. The purpose of 17/11/ · The size of the global foreign exchange market (also known as forex, FX or the currency market), far exceeds any other market. It dwarfs its nearest competitor (futures market) by a ratio of about With an estimated daily volume of more than $5 trillion, the London fixing is a big deal. Out of the $5+ trillion of daily transactions, over 50% exchanges hands through the London session, hence the “London fix” became the Estimated Reading Time: 5 mins The fixed rates are pegged to the U.S. dollar, and the central bank in the countries that use this system holds U.S. dollars to keep the rate fixed. How do forex traders establish currency exchange rates? The market forces of supply and demand are the main factors that determine currency exchange rates. The level of demand for a currency determines its value in relationship with other currencies

Fixed vs floating foreign exchange rates | Talking Forex

The size of the global foreign exchange market also known as forex, FX or the currency marketfar exceeds any other market. It dwarfs its nearest competitor futures market by a ratio of about The London fixing is the benchmark value of a currency pair on any given day from Monday to Friday.

This who are the forex rates fixed rate is settled at the close of the London market at 4pm local time. The majority of transactions go through the books from towhich means, a 1-minute window of frantic activity.

The Forex marketwhere currencies are traded electronically and around the clock, needs to define the best time that would represent the official benchmark rate. If forex was to run its activity through stipulated times in exchanges, there would be no need for the London fix to take place.

These rates are also built into the investment mandates of many tracker funds. The reason that we tend to see above-average volatility around the London fixing is due to the aggregation of bids and offers that get cleared through major banking institutions on behalf of their clients.

The majority of volume at fixings is caused by asset managers. Because of the notion that the fixing reflects the most transparent price of the day, these entities with a fiduciary responsibility, must execute their orders around a particular time of the day to best reflect the official rate.

It encourages asset managers to trade at the fix in order to match the benchmark rates used to value their holdings. You will demand from your broker to get the 4pm benchmark rate at the London fix instead.

This will make sure that instead of being quoted a random price during the day, you will get approximately the average price between the and The benchmark price is published by the WM Company since The rates are calculated by WM, a unit of State Street Corp.

It is important to know the characteristics of the London fixing for several reasons. Since you are alerted when volatility increase happens, the usual spike in prices will not take you aback. By knowing this, you can adjust your stop loss size or profit targets accordingly.

You can also set rules to stay away from a trade altogether. There is one more aspect to consider. The London fix cut-off time is 4pm Monday to Friday, after which, the volumes and trends in the market tend to exhaust.

You will notice a steady trend from around the London open that will run out of juice at the time when the overlap between the London and the New York session ends. There has been plenty of illegal activity around the London fix for a long time, who are the forex rates fixed. Ivan Delgado is a who are the forex rates fixed Forex Trader. Feel free to follow Ivan on Youtube. Join thousands of traders who follow Ivan's insights to increase their profitability rate by learning the ins and outs of who are the forex rates fixed to read and trade financial markets.

Ivan has you covered with in-depth technical market analysis to help you turn the corner. Trading Academy The Daily Edge Trading Videos Trading Guides Discord Chat. Ivan Delgado. Facebook Twitter Reddit WhatsApp LinkedIn. You may also like. July 9, who are the forex rates fixed, About the author.

View All Posts. Ivan Delgado Ivan Delgado is a decade-long Forex Trader. Even the best players have mentors. Finding Asymmetrical Risk Reward Trades In Forex. Share This!

Floating and Fixed Exchange Rates- Macroeconomics

, time: 3:25What is the London fix?

The fixed rates are pegged to the U.S. dollar, and the central bank in the countries that use this system holds U.S. dollars to keep the rate fixed. How do forex traders establish currency exchange rates? The market forces of supply and demand are the main factors that determine currency exchange rates. The level of demand for a currency determines its value in relationship with other currencies 25/06/ · The closing currency “fix” refers to benchmark foreign exchange rates that are set in London at 4 p.m. daily 22/12/ · A fixed exchange rate is a regime applied by a government or central bank that ties the country's official currency exchange rate to another country's currency or the price of gold. The purpose of

No comments:

Post a Comment